Teach Your Kids About Money with the Bank of Mom and Dad

[ad_1]

[Editor’s Note: In today’s WCI Network post, Physician on Fire shows us how he teaches his kids about money. Enjoy! And if you love FIRE or just simply can’t wait to be done with your job, check out his entire website.]

[Editor’s Note: In today’s WCI Network post, Physician on Fire shows us how he teaches his kids about money. Enjoy! And if you love FIRE or just simply can’t wait to be done with your job, check out his entire website.]

How do you teach your kids about money?

It’s a great question. We all want the best for our children, and that includes not making the same money mistakes we’ve made in our own lives.

I don’t have all the answers, but I feel we’re doing a few things right. We’ve been parents for 11 years now, and we’ve got about nine years left with at least one child at home with us. I can’t believe these years are more than halfway over.

I’d like to share some of the tactics we’ve used to teach our kids about money, and that includes “The Bank of Mom and Dad”. We use the term in a different way than most, and it’s been an effective tool in our household.

Let’s Talk About Sex Money, Baby!

What are the two most taboo topics at the family dinner table? Sex and money, right?

There really does need to be some discussion of both, but the birds and the bees talk is probably best reserved for a more private setting in which the details would not result in a loss of appetite and an untouched dinner plate.

Money, on the other hand, should be a part of everyday conversation, including at the dinner table. Dollars and cents shouldn’t dominate the conversation—you don’t want money to be a primary family focus—but as money is a part of everyday life, it should not be ignored.

Talk About Earning Money

Your kids should know that you work hard so that you can live a good life both now and later. It was not unusual for me to be paged away from the dinner table for the first of several after-clinic surgical add-ons when I was on call.

While I didn’t like having to leave, we made sure our kids understood that I was well compensated for being at the hospital’s beck and call for anywhere from 24 to 120 hours at a time.

When your kids are old enough to have some concept of the value of a dollar, consider discussing specifics in terms of hourly pay or annual salary. If you’re worried about them telling their friends, and their friends telling their parents, talk in general terms. You can look up the average salary of your profession with them on a site that anyone can access like glassdoor, for example.

Talk About Spending Money

Kids need to understand that a family spends money in many ways; it’s not just what they might see you buy at the gas station or the liquor store. Did I say liquor store? I totally meant grocery store. Hey, don’t judge.

When I added up the costs in our $220 a day post-FIRE budget, a lot of the spending takes place behind the scenes. It’s the property taxes, health insurance, vehicles, and travel costs that the kids may never witness you pay for, but they need to know about those expenses.

When you pay bills, tell your kids how much those utilities cost each month. You might not insert a nickel into the toilet every time you flush or plop a quarter into the shower every time you cleanse yourself, but that water is not free. Even if you have a well and septic tank, you’ll have to have the tank emptied and the pump replaced occasionally.

For the lights to stay on, the air to be warmed and cooled, and the toilet to flush when you hit the lever, you’ve got to spend some money, and those transactions are hidden if you never mention them.

Talk About Saving Money

As a kid (and as an adult to some extent), I would equate the money I earned with what it could buy. $10 to mow the lawn? That’s 20 packs of Topps football cards! $3,000 for a weekend on call? After taxes, that’s a big flat-screen TV (back in 2007).

Make sure your children know that money is for more than spending, and that you are actually saving a significant percentage of your income. If you don’t know what that fraction is, you can easily calculate your personal savings rate here.

If you’re comfortable with your kids seeing your numbers, show them a pay stub sometime. They can see how much of your earnings are diverted to retirement accounts, Social Security, and income tax.

It’s not a bad idea to talk to them about taxes, as well. Or just do like the fake Bill Murray recommends and demonstrate taxation by eating 30% of your kids’ ice cream.

Talk About Donating Money

In The Opposite of Spoiled, Ron Lieber detailed his three-jar method that he used to split up his kids’ allowance. There’s a Spend jar, a Save jar, and a Give jar. We started with this system and have incorporated it into the Bank of Mom and Dad system that I’ll detail below.

Charitable giving is a primary mission of my website, and we talk about the money we donate with our children. There are times when we’d rather give to causes we believe in and people in need rather than splurge on ourselves. We hope to instill a sense of generosity in our children, as well.

Teach Your Kids About Compound Interest

Saving money becomes a lot more interesting when you understand that investing your money can lead to doubling, quadrupling, octupling, and whatever 16xing your money is called.

When your kids are old enough to understand simple multiplication and division, they’re ready to learn the Rule of 72. With 6% interest, you can double your money in 12 years. At 9% interest, you can have twice as much in 8 years and four times your money in 16 years.

When they’re a bit older, show them the graph that demonstrates how starting to invest at age 25 versus age 35 leaves you with twice as much money by age 65.

If you want your kids to be good with money, they need to understand the benefit of not only earning money, but also of saving and investing it. Understanding compound interest can be highly motivational.

Model Smart Money Habits

If you don’t know how to cook, you don’t want your kids to pick up their culinary skills from you. If you’re not good with money, you’re not likely going to pass along good financial habits to your children, either.

I do credit my father for teaching me the Rule of 72 and showing me the magic of compound interest, but most of my money habits were learned by seeing how my parents spent money.

I do credit my father for teaching me the Rule of 72 and showing me the magic of compound interest, but most of my money habits were learned by seeing how my parents spent money.

We had the means to spend more than we did, but we shopped at thrift stores, browsed the “scratch and dent or open-box” sections at the big box stores, and hit up garage sales most weekends in the summer.

We vacationed as a family, but not at four-star resorts. Sometimes, we went camping and canoeing. We often road-tripped, staying with family.

We did splurge for Disney World once, but we made the trip more affordable by staying in a condo offsite, preparing breakfast there, and packing lunches for the day. We flew to Florida, but drove a rental car back for a great price as the rental companies like to migrate their cars north for the summer.

When you find ways to have nice things and make memories together without breaking the bank, your kids will hopefully take notice. Talking about the costs that you incur and the cost of the full-price alternative can help drive the point home. You don’t always get more when you spend more.

The Bank of Mom and Dad

When you read this phrase in the title, you probably pictured kids repeatedly coming back to the well to fill their buckets with greenbacks from the Bank of Mom and Dad.

That’s not at all what this is about.

In our house, the Bank of Mom and Dad incorporates much of what I’ve discussed thus far: talking about money, compound interest, and making wise money choices.

In 2021, even high-yield savings accounts aren’t offering much more than 0.5% interest. I don’t think my kids are going to be super-stoked about doubling their money in 144 years, especially if I tell them that inflation will annihilate their money’s spending power over that timeframe.

What if they could double their money in under six years? That would mean any money they have in “the bank” now would more than double before they fly the coop at age 18. That’s a bit more enticing, and that’s what we’ve set up.

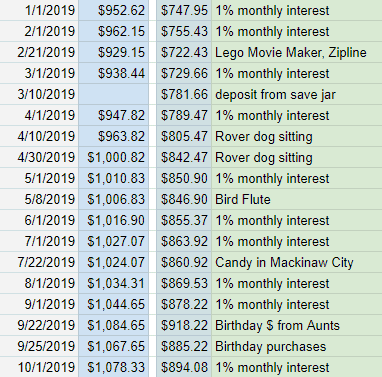

The Bank of Mom and Dad is a simple spreadsheet. It’s a ledger I created on Google Docs with one column for each of our boys.

When they are gifted money, earn money, or empty their Save or Spend jars, I pocket that money and add it to their balance. When they choose to spend their own money, I’ll usually charge it to a rewards credit card and deduct the expense from their balance.

On the 1st of every month, their balance grows by 1%. With a spreadsheet, it’s a quick “=B47*1.01” where B47 is the cell with the most recent balance.

No, our version of the Bank of Mom and Dad is not accepting applications for new accounts. My sincerest apologies.

Until last night, it was a simple black and white sheet, but I added some color to fancy it up for you. Each of our sons has their own column; our 11-year old has a bit more money because he’s celebrated a few more birthdays and holidays. This is what it looks like year-to-date.

note the earned money from Rover dog sitting

We’ve gotten to the point where they’re getting around $10 a month simply by not spending their money. Granted, they don’t have a lot of opportunity to spend money and most of their expenses are covered by us at this point.

Nevertheless, when there’s a must-have Lego set that can’t wait for a birthday or Christmas or they want to spend some money on travel souvenirs, we let them decide whether or not to spend down their balance.

More often than not, the incentive to keep their money invested wins over the impulsive urge to spend. The not-infrequent donating of old toys that happens around here helps keep the fleeting nature of those impulses in perspective.

Teach Your Children Well

Don’t be afraid to talk about money with your kids. Money talk is not the same as money worship. Money is just a tool that allows you to live life the way you want, but kids should know that it will play a prominent role in their lives, just as it does in yours.

Compound interest has been described as the eighth wonder of the world and you want your kids to understand the power of investing early and often.

One of the best ways to instill good money habits in your children is to show them how it’s done. As parents, we often underestimate how likely our kids are to model our behaviors, both good and bad.

Finally, consider bringing it all together by being the bank for your kids, and a generous one at that. Let them know each month how much interest they earned simply by leaving money in their account.

How do you teach your kids about money? What money habits, good or bad, did you pick up from your parents? Comment below!

The post Teach Your Kids About Money with the Bank of Mom and Dad appeared first on The White Coat Investor – Investing & Personal Finance for Doctors.

[ad_2]

Source link