Tax Loss Harvesting with Fidelity: A Step by Step Guide – The White Coat Investor – Investing & Personal Finance for Doctors

[ad_1]

[Editor’s Note: Today’s WCI Network post is from Physician on FIRE and is about tax loss harvesting. This was a really hot topic back in March. If you still have losses in your taxable account, you really missed the boat. Nevertheless, this is a useful tutorial about tax loss harvesting, especially for those who, like me, have an investing account at Fidelity.]

When the stock market gives you lemons, make lemonade.

In December of 2018, the markets delivered lemons by the truckload. We had a drop of about 7% in one week and most major indices for the US stock market were very near bear market territory. In March of 2020, stock markets worldwide fell into bear market territory.

While I don’t enjoy seeing six-figure sums disappear from my portfolio, I try to do the best I can with what I have. When I have an abundance of lots with losses, I squeeze those lemons with a technique known as Tax Loss Harvesting (TLH).

I’ve previously shared a guide to TLH with Vanguard, showing screenshots every step of the way. In that post, I also go into more detail regarding the rationale, benefits, and ways to goof it up, so I encourage you to review that first post if you have questions about TLH and the reasoning behind it.

Recommended Reading From WCI

Tax Loss-Harvesting with Vanguard: A Primer

A Step By Step Guide to Tax-Loss Harvesting

Currently, I only have a taxable brokerage account (the only account type that can benefit from TLH) with Vanguard. However, the couple I helped when they were ready to break up with their advisor uses Fidelity. I found some TLH opportunities for them, and I’m happy to share them with you.

Tax Loss Harvesting with Fidelity: A Step by Step Guide

Tax Loss Harvesting Summary

TLH is the process of selling shares of an asset at a loss. It is typically paired with the simultaneous or subsequent purchase of a similar but non-identical asset.

The process only works in a taxable account, a.k.a. brokerage account. Making a similar trade in an IRA, or other tax-advantaged retirement account will not give you a tax benefit, but you can create an inadvertent wash sale by purchasing in an IRA what you sold from a taxable account, reducing the benefit of your TLH efforts in the brokerage account. More on wash sales later.

As an index fund investor, my experience is in exchanging one fund for another. You can harvest losses with individual stocks, but the difficulty is finding another stock that you can expect to perform similarly. The point of TLH is that you’re taking a paper loss without actually altering your asset allocation significantly.

You can also tax loss harvest with ETFs or between mutual funds and ETFs. You may miss out on time in the market if you’re waiting for the proceeds of the sale to hit your settlement fund before you can use it to buy a TLH partner. This may be inconsequential or even beneficial if the market continues to drop while you’re waiting.

Why Tax Loss Harvest?

When you take a paper loss, those losses will first be used to offset any capital gains you may have incurred that year. If you’re an index fund investor buying and holding, there’s a good chance you won’t have any capital gains to offset in most years.

Once any gains have been canceled out, your tax losses will be used to deduct up to $3,000 per year of ordinary income.

This is key. A high-income professional may have a marginal income tax rate (federal, state, and local) of 35% to 50%. That $3,000 deduction can be worth $1,000 to $1,500 per year.

Moreover, additional losses can be carried over to future years. As I showed in the Vanguard TLH post, in 2016, a year in which the S&P 500 experienced a double-digit gain, I was able to harvest over $50,000 in tax losses. That’s 16+ years worth of $3,000 deductions. If I were to remain in the upper income tax brackets, the monetary value of those TLH efforts would exceed $20,000.

Now, it is true that when you tax loss harvest, you are lowering your cost basis in the funds you own. That could set you up to recapture some of the taxes in the form of paying more capital gains taxes later.

However, it’s well worth it to save on ordinary income taxes now (at 35% to 50% rates) to possibly pay capital gains taxes later at 0% to 35% later. Nearly everyone will pay a lower capital gains rate later than income tax rate now. At worst, you’re deferring the tax.

Additionally, there are ways to avoid capital gains taxes entirely. In retirement, you may be in the 0% capital gains bracket with a taxable income up to $80,000 in 2020. You may be able to take advantage of a free increase in your cost basis in that 0% bracket by doing some tax gain harvesting in that situation.

If you have charitable aspirations, you can donate funds with the lowest cost basis (and most potential gains) to charity. I do this by donating to and from a donor advised fund.

Finally, if you die with assets in a taxable brokerage account, the cost basis is reset to the current value when inherited. Those potential capital gains taxes disappear.

Avoid a Wash Sale

If you sell an asset for a loss, some or all of that loss will be ineligible to be reported as a loss if you have a purchase of the same or a “substantially identical” asset 30 days before or after your TLH sale.

For example, in a previous example of TLH timed with the Brexit vote, I exchanged VFWAX to VTMGX and VTSAX to VFIAX on June 27, 2016.

I could have created a wash sale if I had:

I could have created a wash sale if I had:

- Purchased VTSAX or VFWAX between June 27, 2016 and July 28, 2016.

- Held onto shares of VTSAX or VFWAX purchased between May 27 and June 26, 2016. If I had purchased either VTSAX or VFWAX in that timeframe, as long as I sold them with the other losing lots on June 27, it would not have been an issue.

The purchase of substantially identical shares during that 61-day window would also constitute a wash sale. I would consider the higher cost Investor shares of these Admiral funds to be substantially identical. The same goes for the ETF versions of the funds. They follow the same index and hold the same stocks in the same proportions.

Prevailing opinion from quality sources including Bogleheads is that funds tracking different indices are not substantially identical even if there is significant overlap.

In today’s examples, I’ll demonstrate exchanging Fidelity’s Total Market Index Fund (FSKAX) for their No-Fee ZERO Total Stock Market Fund (FZROX). The former tracks the Dow Jones U.S. Total Stock Market Index while the latter tracks a new proprietary index from Fidelity.

Similarly, we’ll be selling Fidelity’s Total International Index Fund (FTIHX) for their No-Fee ZERO International Index Fund (FZILX).

The best way to avoid making an accidental wash sale is to turn off automated investments and automatic reinvestment of dividends. It’s also good practice to avoid holding substantially identical funds in any IRAs that your or your spouse periodically invest (or reinvest dividends) in.

401(k), 457(b), 403(b), HSA, and similar accounts fall under the “gray area” category in my mind (and that of Michael Piper, the Oblivious Investor). I personally avoid holding substantially identical assets to that which I hold in taxable in such accounts to be squeaky clean when I TLH.

Turn Off Automated Dividend Reinvestment

The first thing I did was to turn off automated dividend reinvestment. While I don’t expect another dividend to be paid out until March, it’s best practice to manually reinvest dividends to whichever asset class is below your chosen asset allocation based on your Investor Policy Statement. In the future, there may be TLH opportunities near an ex-dividend date.

I couldn’t clearly see how to do this, so I used the search box in the upper right hand corner. That led me to this page, which had the big blue button I needed.

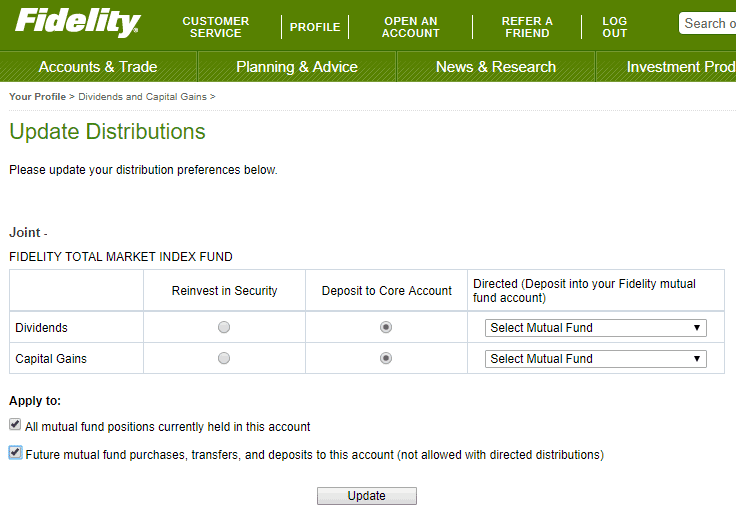

If your Dividends and Capital Gains say “Deposit to Core Account,” you’re good to go. If they say “Reinvest in Security” or something different, you’ll click on “Update.”

That will lead you to the following screen. I’ve chosen to deposit to Core Account rather than direct them to a single mutual fund. I was able to apply to all mutual funds in the account with a check in the box.

TLH Step 1: Identify Losing Lots

First, click on the “Positions” tab to see what you own. To see the individual lots, first, click on the fund name and then on “Purchase History / Lots.”

“Today’s Gain/Loss” is not relevant to what we’re doing today. We’re interested in the Total Gain/Loss of each individual lot displayed. In this case, only the four most recent lots purchased have a loss (displayed in red). We’re in the green for any lots purchased in 2016. We only want to sell the reds.

Fidelity will be asking how many shares I want to sell. To add up 325.331 + 474.69 + 7080.462 + 264.480, I copied the data via mouse and pasted into a Google Sheet.

Selecting the four values from the Quantity column and selecting the “SUM” function, I see that I want to sell 8,144.922 shares of FTIHX. I could have used a calculator, but this way is honestly easier and less error-prone, particularly if you are selling dozens of lots at once as someone who invests with each paycheck might be doing.

TLH Step 2: Exchange One Fund for Another

I’ve decided to exchange shares of FTIHX into another international fund Fidelity offers, the No-Fee ZERO International Index Fund (FZILX). While these will track similarly, they are not identical, a fact that is demonstrated with a quick comparison of their recent history. Most of the difference comes from the dividend paid out on 12/7 from FTIHX but even before that, there were slight differences.

I click the green “Trade” button.

In the popup, I select “Specific Shares.” You can also select the default cost basis elsewhere, but regardless of what selection you have for your cost basis, the “Specific Shares” option will be there for you to choose. The Vanguard equivalent is “Specific ID,” which must be specified beforehand to sell specific lots.

In order to exchange one fund for another without sitting out of the market for any length of time, I choose “Sell a Mutual Fund and use the proceeds to buy another mutual fund.

Next, I enter the new fund I’m buying and the number of shares in the losing lots that we calculated earlier.

I’ll be asked how I want to see the lots displayed. To make things easier, I’ll opt to arrange by highest cost. The highest cost lots are most likely to have tax losses.

After that, I choose to sell only the losing lots. Just as they were above, the numbers will be in red. Next, I verify that the information is correct. Fidelity doesn’t want to see frequent trading, and selling a fund purchased within 30 days is considered a “roundtrip transaction.” More than four of these in the same account will put a hold on your ability to trade for a while. More information is available in Fidelity’s Excessive Trading Policy.

Turning off the automatic dividend reinvestment will limit the number of roundtrip transactions possible, another reason to make that change, which I’ve done.

After checking the box and clicking on “Place Order,” we’re done!

A Simple Fidelity TLH

That first one got a bit complex due to the mix of lots with both gains and losses.

This brokerage account also holds a fund (FSKAX) with only losses, no gains. In this next example, we’ll simply sell the fund in its entirety since all four lots have capital losses.

Like above, we’ll make a direct exchange. This time, we’re trading Fidelity’s Total Market Index Fund (FSKAX) for their No-Fee ZERO Total Stock Market Fund (FZROX). The two will be expected to correlate extremely closely, but they mirror different indices and are therefore not considered by most to be substantially identical.

When expanding by clicking on “Purchase History / Lots,” I see that all our lots purchased have losses. Again, we don’t have to worry about selling specific lots. From the dropdown box, I choose “Sell All Shares and use proceeds to buy another.”

In the box that’s partially hidden above, I enter the name of the fund I’ll be buying, FZROX.

A click on “Preview Order” and I get an opportunity to look things over. Once again, it’s a “roundtrip transaction.” Some of the proceeds from a Required Minimum Distribution were invested here and a dividend was reinvested within the last 30 days. No worries. I can do this; I just can’t do it too often.

We’re ready to click “Place Order” to harvest those tax losses.

That’s all there is to it!

The Results of This Tax Loss Harvesting

In addition to the two TLH events recorded above, I also sold some losing lots of a third fund, one of the active funds that we were stuck with (but have now decided to sell without tax consequence, using some of our newly-acquired paper losses to offset the smaller gains).

As you can see in some of the screenshots above, these transactions were entered on Sunday, 12/23/2018. As these are mutual funds, the orders were executed at the next closing bell.

It just so happens that 12/24/2018 was a very, very bad day for the stock market, with the largest drops in either percentage or absolute value on a Christmas Eve day. In other words, it was a good day to tax loss harvest.

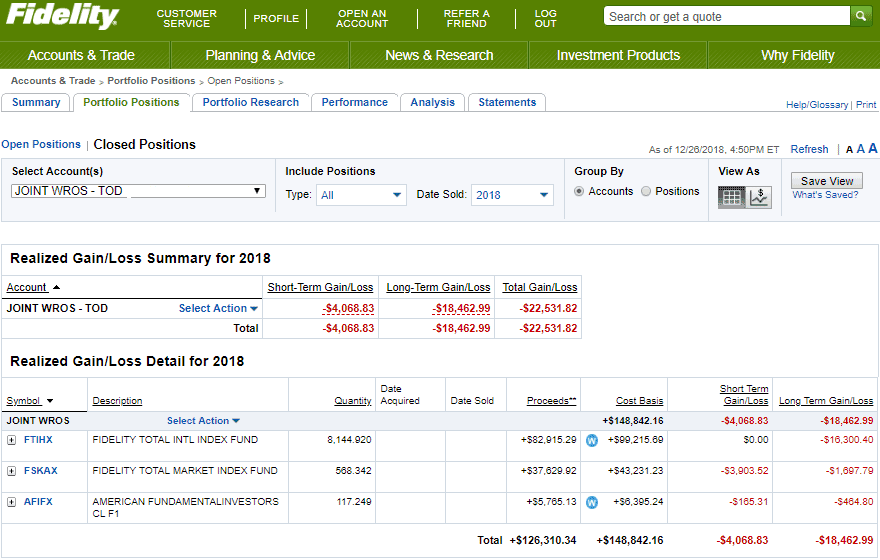

A couple of days later, I clicked on “Closed Positions” to see the results of my efforts.

Altogether, we had $22,531 in paper losses in three transactions, with $4,069 in short-term losses and $18,463 in long-term losses.

Both short-term and long-term losses can be used to offset ordinary income or either type of capital loss. Short-term first offset short-term gains and long-term losses first offset long-term gains, but short-term losses can offset long-term gains, and vice-versa.

It’s Your Turn to Tax Loss Harvest

While it may look complicated, it’s only because I captured nearly every screen shot in the process. In practice, once you understand the concept and can navigate the website, it shouldn’t take more than a few minutes to properly execute a tax loss harvesting transaction.

By harvesting about $20,000 in losses in these two transactions, this couple’s ordinary income will be reduced by $3,000 this year and for up to five or six more years.

Alternatively, they could use some of the remaining carryover losses to sell out of the final two actively managed funds remaining in their taxable account. We did our best when simplifying this portfolio from 28 funds, but to avoid paying capital gains taxes, we couldn’t quite whittle it down to a three fund portfolio.

Now, with only about $10,000 in gains in those tax-inefficient funds, they can be sold without having to pay the capital gains taxes on the sale. That would eat up a few years’ worth of potential ordinary income deductions, but I’m not too concerned.

I have a feeling we may be harvesting additional losses in the future.

As daunting as the concept may at first seem, tax loss harvesting is not a difficult task. I hope I’ve made the benefits clear and the process approachable. For more tips on effective and simple tax loss harvesting, please read my Top 5 Tax Loss Harvesting Tips.

If you happen to be a Vanguard user, I’ve got a step-by-step guide for you, as well. Tax Loss Harvesting with Vanguard: A Step by Step Guide.

Have you taken advantage of tax loss harvesting yet? What are your favorite trading partners?

[ad_2]

Source link