Should I File Taxes Separately For Student Loans? | White Coat Investor

[ad_1]

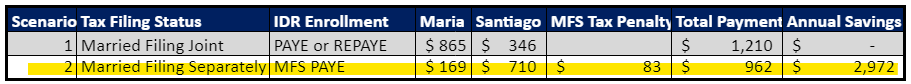

- Attributed monthly to Maria’s loans ($145,250 x 10% / 12) x 71% = $865

- Attributed monthly to Santiago’s loans ($145,250 x 10% / 12) x 29%= $346

- Household monthly payment $145,250 x 10% / 12 = $1,210

By filing taxes MFJ, the monthly payment is distributed based on your % of loan balance.

Note, Maria’s loans are 71% of the overall loan balance and Santiago’s are 29% which is how monthly payments are attributed to their loans.

Annually $14,525 would be paid on their loans. With $10,375 applied to Maria’s and $4,150 to Santiago’s. Seems a bit counterintuitive as Santiago is making more money and more is allocated to Maria’s loans. It’s important to remember when filing taxes MFJ, they calculate your portion of the loan payment based upon your % of household student loans.

Negative Amortization Student Loans

Another important point is that in Revised Pay As You Earn (REPAYE), if your monthly payments don’t cover the monthly interest accrual, 50% of the unpaid interest is covered by an interest subsidy. The technical term for this is called negative amortization. The overall student loan balance grows more slowly if you’re enrolled in REPAYE during negative amortization.

Using our example, $700,000 in loans at a 6% interest rate grows at a rate of $42,000 per year. $14,525 is their required annual student loan payment leaving $27,475 in accrued unpaid interest for the year. 1/2 of this unpaid interest ($13,737.50) is paid for by a government subsidy. Calculations below:

- Annual Accrued Interest: $700,000 x 6% = $42,000

- Unpaid Accrued Interest After Student Loan Payment: $42,000 – $14,525 = $27,475

- Unpaid Accrued Interest After Government Subsidy: $27,475 X .5 = $13,737.50

- Outstanding Loan Balance: $700,000 + $13,737.50 = $713,737.50

Let’s look at how much they would be paying if they use MFS.

Scenario 2 MFS – PAYE

Maria and Santiago Perez both enroll in PAYE and file using MFS status. This allows them to exclude each other’s income from their student loan calculation. An added bonus is they both still benefit from the poverty line deduction for their household of four on their individual tax returns.

AGI: Maria: $60,000, Santiago: $125,000

Tax Filing: Married Filing Separately

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

IDR Plan: PAYE (10% of Discretionary Income)

- Maria $60,000 – ($26,500 x 1.5) = $20,250

- Santiago $125,000 – ($26,500 x 1.5) = $85,250

- Maria’s monthly payment $20,250 x 10% / 12 = $169

- Santiago’s monthly payment $85,250 x 10% / 12 = $710

- Total monthly payment $169 + $710 = $879

Filing taxes MFS reduces their overall monthly payment by $331 per month compared to MFJ. This is an annual savings of $3,972.

Keep in mind, annual taxes paid would increase by approximately $1,000 ($83 per month) for the year by filing MFS. But, the net savings is $2,972 a year.

The overall cost savings is a critical calculation for each client to help them decide if MFS is most advantageous for their situation:

Scenario 2 Annual savings in student loans ($3,972) – increased tax burden ($1,000) = Overall cost savings ($2,972)

Scenario 3 MFS – PAYE/REPAYE

Maria and Santiago Perez file taxes MFS. Maria enrolls in PAYE and Santiago in REPAYE. Maria’s monthly payment will be the same as above ($169). We already calculated Santiago’s payment as well in the MFJ example above. In the calculations we’ll show a nuanced loophole that can reduce their payment.

AGI: Maria: $60,000, Santiago: $125,000

Tax Filing: Married Filing Separately

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

- Maria enrolls in PAYE (Payment is 10% of Her Discretionary Income)

- Santiago enrolls in REPAYE (Payment is 10% of Joint Discretionary Income)

- Maria $60,000 – ($26,500 x 1.5) = $20,250

- Santiago $125,000 + $60,000 – ($26,500 x 1.5) = $145,250

- Maria’s monthly payment $20,250 x 10% / 12 = $169

- Santiago’s monthly payment ($145,250 x 10% / 12) x 29% = $346

- Total monthly payment $169 + $346 = $629

Recall with REPAYE, you ALWAYS look at joint discretionary income regardless of tax filing status. With Santiago enrolled in REPAYE, his student loan payment is calculated from their joint discretionary income. However, he’s only held liable to his portion of the household student loan debt, which is 29%.

Essentially, 29% of the REPAYE monthly payment is due from Santiago. The other 71% isn’t charged to Maria because she’s in PAYE. Effectively creating a shield to block higher payment for Maria.

Scenario 3 would put an extra $7,340 in the Perez’s pocket annually.

Time to take a quick break on scenarios.

The scenarios above are for couples in common law states. If you live in California, Texas, Arizona, New Mexico, Louisiana, Nevada, Idaho, Washington, or Wisconsin you’re in a community property state. Couples in community property states who file taxes MFS have an even GREATER opportunity to lower their monthly student loan payment.

The main reason is how the IRS calculates your AGI. Unlike common law states, community property AGI isn’t the sum of both of your incomes. Instead, they equalize your income by summing your incomes together and divide it in half.

With a reduced household AGI you can expect a lower monthly payment for the higher-earning spouse. On the flip side, this raises the AGI for the lower-earning spouses and increases that portion of the monthly payment. Sounds like an overall wash for student loan payments as the high earner pays less and low earner pays more.

But wait, here’s the trick to help the lower earner keep a low payment. Next time you recertify your income use alternative documentation of income (pay stub) instead of your most recent tax return. They will base your student loan payment solely off your pay stub or income, thereby reducing your monthly student loan payment.

Here’s an example.

Scenario 4 MFS PAYE/REPAYE in a Community Property State

Let’s suppose Maria and Santiago Perez were living in Wisconsin, a community property state, filed taxes MFS and enrolled in IDR with Maria in PAYE and Santiago in REPAYE. There’s another loophole here, so pay close attention.

AGI: Maria: $60,000, Santiago: $125,000

Tax Filing: Married Filing Separately

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

- Maria enrolls in PAYE (10% of Her Discretionary Income)

- Santiago enrolls in REPAYE (10% of Joint Discretionary Income)

Community Property: Maria AGI $60,000 + Santiago AGI $125,000 = $185,000 / 2 = $92,500

- Maria $60,000 – ($26,500 x 1.5) = $20,250

- Santiago $92,500 + $60,000 – ($26,500 x 1.5) = $112,750

- Maria’s monthly payment $20,250 x 10% / 12 = $169

- Santiago’s monthly payment ($112,750 x 10% / 12) x 29% = $268

- Total monthly payment $169 + $268 = $437

Living in a community property state has reduced Santiago’s AGI. The reason is that in community property states, the law equalizes spousal income, allowing Santiago’s income to drop from $125,000 to $92,500. Higher earning spouses in community property states can take advantage of lower student loan payments.

If Maria’s AGI was based on her tax return, her AGI would actually increase from $60,000 to $92,500, effectively increasing her discretionary income and student loan payment. We get around this by having her enroll in PAYE and submit income recertification with alternative documentation of income. Which allows her to report current income of $60,000 versus the $92,500 she’d report if using her tax return.

Scenario 4 annual savings in student loans ($9,276) – increased tax burden ($1,000) = Cash savings ($8,276)

The Bottom Line: Tax Filing Status Is Integral to Maximizing Your Student Loan Plan

Here’s a flowchart to summarize what we’ve discussed and to help you quickly identify if married filing jointly or married filing separately is right for your situation.

Wow, we covered a lot of ground and just scratched the surface on how integral tax filing status is to your overall student loan plan and finances. Student loan repayment options are tricky for dual-income married couples, but you can see that by paying close attention to nuanced details, you can save a significant amount of money.

Every couple’s situation is unique, and if you’re still wondering what the right filing status is to reduce your student loan payments, our student loan consultants are ready to help. Our team of experts will guide you through all your options to tackle your student debt and help you find your optimal student loan plan. Ready to save money and take the confusion out of your student loans? Book a Consult with our student loan experts today.

[ad_2]

Source link