IRR and Equity Multiple in Real Estate Investing | White Coat Investor

[ad_1]

[Editor’s Note: Today’s WCI Network post is from Passive Income, MD and will help you become more financially literate by understanding two important terms used frequently in real estate investing. Enjoy!]

As I started writing my series on the Guide to Syndications, I realized it was impossible to discuss how to evaluate a deal without first taking a deeper dive into the terms “Internal Rate of Return” (IRR) and “Equity Multiple”.

You’ll find these terms used side by side in investment summaries to help potential investors vet the investment.

“Cash-on-Cash Return” is often used as well, but we’ve discussed that in a previous post.

So let’s take a deeper dive into both IRR and Equity Multiple and figure out which is the better metric for evaluating and comparing investment opportunities.

Internal Rate of Return

The technical definition of IRR is the discount rate that makes the net present value of all cash flows from a particular project (including your initial investment and returns) equal to zero. Wait, I know what you’re thinking… “What the heck does that mean?”

In simpler terms, it’s a way of calculating your return on an investment but accounting for the time value of money. Since returns in some investment opportunities are sporadic and uneven, IRR tries to account for this.

Time Value of Money

The time value of money is the idea that money today is a lot more valuable than money returned in the future. For example, a dollar today is worth more than a dollar you’ll receive five years from now. This is due to the erosion of value resulting from inflation but also because of the lost opportunity cost of those funds (you could have invested that money elsewhere in the meanwhile and gotten a return).

So to get back to our main topic, IRR accounts for the time value of money when it comes to investment returns. Another way to say this is the IRR accounts for the fact that the later in the deal you get your return, the less valuable it is.

Equity Multiple

Equity Multiple is another measure of the total return paid to the investor. (It’s also the namesake of one of our affiliate crowdfunding partners, EquityMultiple.)

Equity Multiple = cumulative distributed returns / paid-in capital

Another way to say this is that Equity Multiple equals the total amount returned to you over the life of the investment divided by the amount you initially invested.

Unlike IRR, Equity Multiple does not take into account the length of the investment period or the time value of money.

Here’s a simple example:

If the Equity Multiple is 2.0x and an investor puts in $25K, the projection is that the investor will receive $50K, double the original investment (the total includes the original $25K investment, so the profit is $25K).

If the Equity Multiple is 1.8x for a $10K investment, you would expect to receive $18K in total returns by the end of the investment ($10K original investment + $8K in distributions).

Pros and Cons of Each

Internal Rate of Returns

Pros

- Accounts for the timing of returns

- Makes it easy to compare two different investments with uneven returns

Cons

- Can be manipulated by savvy operators changing the timing of returns

- Can be more complicated because there are so many factors to consider, including refinancing, sales, increasing rent, and changes to the operating budget

- Doesn’t measure how much money you receive, only a percentage yield

- Assumes that you will reinvest the returns right away

Equity Multiple

Pros

- Easy to understand

- Clean, simple calculation without much room for manipulation

- At the end of the day, you’ll know how much cash you will receive

Con

- Does not account for time value of money, meaning it doesn’t account for the timing of returns or how long your money is tied up in the investment

Example Using Both IRR and Equity Multiple

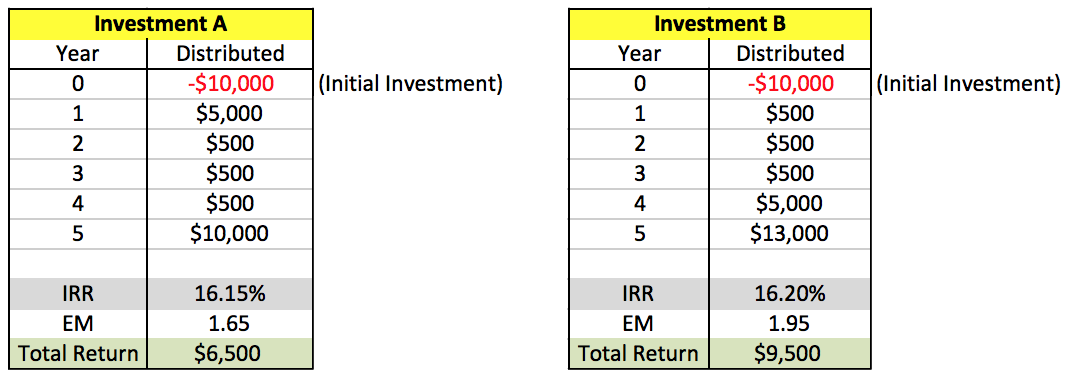

In Investment A and Investment B, the IRRs look very similar. Based on that factor alone, the investments seem comparable. However, if you look at the Equity Multiples, the absolute cash returns are different.

Even though the total return is different, the IRRs are similar because in Investment A, you receive a large portion of your capital back very early on, and you have the ability to utilize that capital in other investments.

If you’re eager to gain your capital back and you have other opportunities lined up, you might prefer the Investment A. However, if upon getting your capital back it just sits in a savings account at a 1% interest rate, you would have benefited more from the Investment B scenario, where it stays in the deal and produces a greater overall return and a higher Equity Multiple.

Better to Use Both Metrics

So you can see how looking at both metrics can give you a better idea of what type of deal is most in line with your goals and objectives.

As a basic rule of thumb, investors who are more concerned with maximizing yields at all times (ie. having your money work as hard as it possibly can at all times) might be more interested in offerings with a higher IRR.

However, investors who care about absolute numbers and returns, and who are trying to build up long-term wealth, might be more interested in finding deals with the highest Equity Multiples.

Obviously, it would be nice to have the highest IRR and Equity Multiples. However, taking into account all three metrics—Cash-on-Cash Return, IRR, and Equity Multiple—will help give you a good understanding of the investment opportunity before you.

What do you think? Which of these metrics is most important to you when evaluating a deal? Comment below!

Subscribe to the Passive Income, MD Blog

[ad_2]

Source link