Don’t Give Up On Your Small-Cap Value Strategy – The White Coat Investor – Investing & Personal Finance for Doctors

[ad_1]

Factor investing is the idea that you should not only diversify your portfolio by holding many different securities (stocks and bonds) within each asset class in the portfolio, but also that you should spread your bets among the various “factors” that explain past stock market returns. Some of these factors include:

- Small

- Value

- Momentum

- Quality

There may be hundreds of factors that have been “discovered” by data-mining the limited retrospective data set that is the history of the world’s financial markets. The two most popular of these are the small and the value factor. They are so popular that entire mutual fund companies have been designed around them and economists have been awarded Nobel prizes based on their work with them. Naturally, there are lots of people that believe in and don’t believe in factors, causing this to be a controversial area of investing. What is certain, however, is that in the past and over the very long term (in our limited data set), small and value stocks have outperformed large and growth stocks. Obviously this is retrospective data, with all of the limitations that entails, and it is entirely possible that it is simply an artifact of the process. But the data is fairly robust, persistent across many time periods and countries in the world.

Believers in Factor Investing

Many smart people, including:

believe that small value stocks are highly likely to outperform the rest of the stock market over the very long term. Of course, nobody really knows why.

Why Does Small-Cap Value Outperform?

There are two basic explanations, the “risk story” and a behavioral bias.

The risk explanation is simply that small value stocks are riskier than other stocks. The companies are not very large and may rely on a single product or service. As value stocks, they are also generally not leaders in their industry and are more likely to go out of business than growthier stocks of the same size in the same industry.

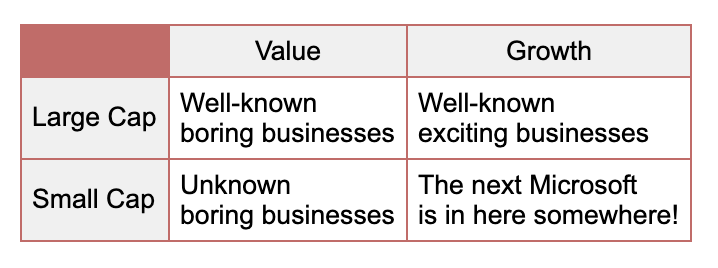

The behavioral bias was perhaps explained best by MoneyChimp and Bill Bernstein. Basically, small value stocks are boring but profitable. Nobody is going to brag at a cocktail party about their small value stock performance. People either want Google or Amazon (or better yet the next Google or Amazon.) I mean, maybe Exxon or Wal-mart is okay, but nobody is interested in a small-cap company like AptarGroup Inc, even if they are a world leader in the global dispensing solutions industry.

Bill Bernstein argues that small growth stocks have the lowest historical returns (as displayed below) due to the lottery ticket effect (as explained above).

Theoretically, there are some people out there that are total believers in small-cap value tilting. They put all their equities into small-cap value stocks (and perhaps offset them with a higher than normal allocation to safe, short-term treasury bonds in what is known as the Larry Portfolio). There is obviously some risk there, given that only 2% of the overall stock market lives in that box.

The Total Stock Market Fund

Then there are people who don’t believe in tilting their portfolio at all toward small value stocks. They believe that decreases your diversification, increases your costs, and makes it difficult for you to stick with your portfolio due to tracking error with the overall market.

However, that leaves a lot of people in between those two points on the spectrum. These folks are the tilters, and I’m one of them. They tilt their portfolio toward small value stocks, essentially making a bet that small value will outperform, but without betting the farm. It’s really important you don’t tilt more than you believe, of course, because the worst thing you can do (assuming a small value tilt will pay off in the long run) is bail out of a small value tilting strategy just before it pays off.

In my case, my US stock portfolio looks like this:

- 25% Total Stock Market Index Fund

- 15% Small Cap Value Index Fund

Yes, I know those two numbers don’t add up to 100%, but that’s because my portfolio also has 20% international stocks (split 15% large, 5% small), 20% real estate, and 20% bonds. That’s actually a pretty decent tilt. Let me demonstrate, again using the Morningstar Instant X-ray tool. Remember, the graph above is a portfolio that is 100% US Total Stock Market. This one is a 100% Small-Cap Value Index Fund, at least the Vanguard version of such.

Vanguard Small-Cap Value Fund

As you can see, even a “100% small-cap value” portfolio isn’t 100% small-cap value, but it does have 12X as much in small-cap value stocks as the overall market, along with 4X as much in mid-cap value stocks, 9 times as much in small blend stocks, and 3.7X as much in mid-cap blend stocks. There are, of course, even smaller and more valuey funds out there, such as

The DFA Small-Cap Value Fund

which is obviously much smaller and more valuey. You can get even more extreme with

The S&P 600 Value ETF (RZV)

If you prefer one of these funds, you can get to the same weighting using less of it. In my case, I use the Vanguard Small-Cap Value fund because it is convenient, widely available, and very cheap. I just use a little more of it to make up for the fact that it isn’t as small and valuey as other options. But if you take my portfolio, 25% Total Stock Market and 15% Vanguard Small Value, the x-ray looks like this:

My Portfolio

So I have 5 times as much in small value, 4 times as much in small blend, 2X as much in mid value, and 2X as much in mid blend as the overall market. That’s about as much as I’m comfortable with in the long run, because I know there is at least a small chance that this bet will not pay off over my six-decade investing career. However, it is a bet I am willing to make. If you have also made this bet, I would caution you not to change it now. If you have not made this bet, I would suggest you at least consider doing so.

The Case for Small-Cap Value NOW

Let me explain why I think small-cap value is still a smart, long-term bet.

# 1 Recent Small Value Performance Sucks

Small value has outperformed the overall market in the long run. But in the recent past, which is now a substantial period, it has underperformed the market. Our natural tendency as investors is to performance chase, that means we buy what has done well recently and sell what has not done well recently. Unfortunately, this natural tendency often works to our detriment as we end up repeatedly buying high and selling low, abandoning a strategy just before it has its next day in the sun as most strategy and asset classes eventually do. Let’s consider just how poorly small value has done recently. This data was taken from Morningstar on 4/14/2020.

As you can see, small value performance has been terrible for basically my entire investing career. It’s been terrible recently and it’s been terrible for quite a long time. Even going back all the way to 2005, it’s underperforming the overall market by over 2% a year! That’s massive underperformance.

So that leaves you to decide what is most likely to happen going forward. There are four possibilities:

# 1 Small value will underperform the market forever. Obviously, if this were to occur, you would not only want to avoid tilting to small value, but you would want to actively bet against it.

# 2 Small Value will continue to underperform for a while. If this occurs, the best thing to do is avoid small value for a while. This is difficult to do because it requires you to time the market.

# 3 Small Value will now perform similarly to the market going forward. If this occurs, it does not matter if you tilt toward small value or not, you’ll end up with essentially the same thing (minus any difference in expenses).

# 4 Small Value will “return to the mean” and now outperform the market for a while, most likely quite dramatically. If this occurs, you’ll be glad you overweighted small value.

Consider the likelihood of each of these four scenarios, given where we are at today. While there is no guarantee of a return to the mean, a review of the data would suggest that it is the most likely outcome.

# 2 The Gambler’s Fallacy Does Not Apply

It isn’t that small value is just “due.” This is known as the Gambler’s Fallacy. Imagine you’re at the roulette table and the ball has stopped on black seven times in a row. A gambler might say that red is now “due”, but the truth is that the next spin is no more likely to land on red than it is to land on black. That is not the case with small value stocks because it isn’t a random event. Every time small value underperforms the overall market, it becomes more likely to outperform in the future because its valuation goes down. Essentially, you can buy a dollar of earnings for less and less money every time it underperforms. The worse it does, the better deal it becomes. Consider this chart conveniently compiled by Franklin Templeton and published on Seeking Alpha:

On the X-axis, we have all the years since our last major crisis in 2008. On the Y-axis, we see the relative price to earnings ratio of small value to large value. As you can see, at the peak in 2012, you were paying 27% more for a dollar of earnings from a small value company as you were for a dollar of earnings from a large value company. That has since reversed and as of the end of 2019, you were paying 12% less for a dollar of earnings from a small value company, on average. A comparison of small value stocks to large growth stocks would likely be even more impressive.

# 3 Beware Cherry Picking Time Periods

Under # 1, I demonstrated terrible short to medium term performance for small value compared to the overall US market. What happens if you add just a few more years to that analysis? Instead of stopping in 2005, go back to 2000. Again courtesy of Franklin Templeton, we have the answer:

From 2000 to 2005, small value performed so well that it overcame the underperformance of the entire last 15 years and then some. Performance is very dependent on the time period selected. Remember that post I did a while back on the Periodic Table of Investing? If you look at those tables in that post, you’ll see that I have data on small value from 1988 to 2007. After 2005, I use the actual data from the Vanguard ETFs. Let’s reproduce it all here in a form that is easy to read.

I have marked the better performing asset class in red. As you can see over this 32 year period, small value beat the market 17 times, slightly more than half of the time. Overall, $10,000 invested in 1988 in the overall market turned into $270,109 and $10,000 invested in small value turned into $337,330. The overall annualized returns were:

- Total Stock Market: =RATE(32,0,-10000,270109) = 10.85%

- Small Value: =RATE(32,0,-10000,337330) = 11.62%

But what I mostly want to point out with this data is that the pendulum swings back and forth. Let’s just quickly graph the differences in return over the years.

Everything above 0% shows overall market outperformance. Everything under 0% shows small value outperformance. Counting 2020, 6 of the last 7 years small value has underperformed. After looking at this chart do you really want to bet on that trend continuing going forward? I don’t, and in fact, I haven’t. I want you to particularly look at the years AFTER a major crisis, 1991-1993, 2003-2006 and 2009-2013. Small value won all of those years. I can’t tell you when our current crisis will end, but when it does, I would expect good things from small value stocks.

# 4 Overperformance Generally Follows Underperformance

Let’s go back even further. Eric Nelson is a financial advisor, a huge fan of factor investing, and a frequent commenter on this blog. He wrote a piece recently about this topic entitled Small Value Down But Not Out. He compared a portfolio composed of the S&P 500 stocks to one which was tilted to large and small value stocks and looked at all the 10 year rolling periods since 1928. So 1928-1937, 1929-1938, 1930-1939 etc. What he found was that the tilted portfolio outperformed in 82% of those time periods and by an average of 2.8%. But the more impressive finding was that if you look at the 18% of periods when the tilted portfolio underperformed, the average outperformance in the NEXT 10 years was +4.9%. He made this chart using DFA funds. Take a look at the “lost decade” of the 2000s and compare it to the 2010s.

Now ask yourself if you think the next decade is going to be more like the 2000s or more like the 2010s.

My Argument

My point in writing this post wasn’t to try to convince you to tilt your portfolio. I think there are very strong arguments that can be made for a total market-based portfolio without any tilts. However, I also think there are strong arguments that can be made for a tilted portfolio. My own portfolio reflects my ambivalence on this topic (heavily small value tilt on the domestic side and a more moderate small-only tilt on the international side).

My point in writing the post was to show that NOW is not the time to change from a small-value-tilted portfolio to a non-tilted portfolio. In fact, I would argue that it is just the opposite. If you really think you want a tilted portfolio for the long-term going forward, now would be a pretty good time to implement it.

Most importantly, it is critical to realize that implementing a tilted portfolio is a life-long decision. Even 10-15 years is considered short-term when it comes to decisions like these. If you are not convinced that a small value tilt is going to pay off in the long run, you will be unlikely to be able to maintain the portfolio through periods of time like the last 15 years when it underperforms. This is unlikely to be the only period of underperformance you will see in your lifetime with this strategy. Don’t tilt more than you believe and if you do tilt, tilt for the rest of your life.

What do you think? Are you a tilter/slice and dicer? If so are you sticking with your strategy or have you changed it? Comment below!

Not sure what the best asset allocation is for you? Visit with one of our Recommended Financial Advisors who can help you design a portfolio to reach your goals!

[ad_2]

Source link